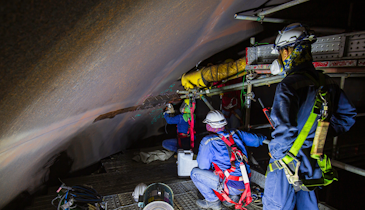

Technician Dustin Steele (left) uses the air lance, while operator Shawn Addison operates the mechanical boom of a Dino suction excavator (MTS GmbH; distributed by OX Equipment) during an excavation job near Danvers, California.

A couple of years ago, a customer asked Sharon Bonner if there was a way to reduce the high costs associated with transporting and disposing of mud spoil generated by hydroexcavating. As the owner of Bradley Tanks Inc. (BTI), a waste-hauling and frac-tank-rental company, Bonner did...